The Lean Product Process: #4 Achieving Product-Market Fit

In the previous articles the series, we took a look at how

With this article, we have arrived at the last stage of the lean product development process: the product-market fit stage. But what does this actually mean? Simply put, when in the product-market fit stage, we are looking to prove that our business model will be sustainable.

If we break up this core question, we should be looking to prove the following assumptions:

- users are still willing to pay or exchange value for our product or service

- we can keep our existing users, maybe even sell the additional products or services

- users like our product so much, they are willing to refer it to others

These assumptions are called growth hypotheses.

At the beginning of each stage of the lean product process, my less experienced clients always eagerly ask me if they can start building the polished product already. As we have already proved that others face the same problem as us, which our product does solve, while providing the expected user experience, they are easily forgiven for thinking we need an actual product to investigate if our customer acquisition and retention strategy are sustainable.

However, those who are more experienced already know that my answer will be the same. No, you still shouldn't invest resources and energy into building a product. Luckily, we have tools at our disposal, which we can use to test our business model before launching ourselves into costly product manufacturing or software development.

Naturally, there are some metrics we can only access once we start selling the actual product. Hence, I will divide this article into two parts: pre-product and post-product tools and metrics.

Tools to test product-market fit before building your product

Landing pages

A landing page is a cost-effective method to gauge interest among our target audience. There are many ways to build a landing page. The easiest is to use a drag and drop website builder such as Squarespace, Wix or Strikingly. If we wish to have more control and customisation, we could use a WordPress theme. Anything more than that would be overkill.

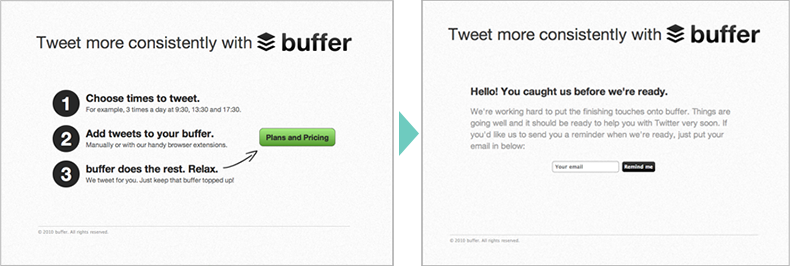

We have to show our value proposition, key advantages and functions of our product. What is even more important is to display the price of our product and a buy button. Yes, a buy button. Even if we don't have a product yet.

After clicking the buy button, we will explain to our users that the product doesn't exist yet, and this is a test. Of course, there won't be any financial transactions happening. But the fact that they are clicking an actual buy button is the strongest commitment feedback we can get of their intent to purchase.

When we finalise the product, we shouldn't, of course, forget to notify users that the product is now available to buy. To alleviate their disappointment of not getting their hands on our product, we could offer an early-bird coupon to users who return and buy later.

Coming soon page

If you find the above method too aggressive, we could use a coming soon page instead. In this case, we make it clear to the user from the get-go that the product is not available yet. If they're interested in buying, they can sign up for a newsletter, through which we will announce developments regarding the product. But one does feel that this isn't as strong a commitment as clicking a buy button.

Pre-purchase

An in-between solution could be to provide a pre-purchase option on the landing page or the coming soon page. We make it clear to the user that the product will only be available later, but in this case, a financial transaction will happen, which is a very firm commitment from the user.

A pre-purchase system could prove to be an attractive option from a cash-flow perspective since we can use this money to finance manufacturing or software development. But this solution is the one which carries the most risk as well. If we fail to prove product-market fit or face obstacles during production, we will be forced to refund our customers.

Product demo video

Another option would be to use a product demo video instead of a landing or coming soon page. Or even better, use them together. Combine the product video with a sign-up, pre-purchase or buy button to measure the intent to purchase. Dropbox used this method in 2007:

Crowdfunding campaigns

When talking about crowdfunding campaign services, such as Kickstarter or Indiegogo, most don't think of them as a tool for validation. In reality, besides being a great way to get funding, they are an excellent way of gauging interest in our product. If people are willing to back our project with money, that is a great indication they would be interested in buying the product later on.

More cunning startups are often not even in need of funding. Instead, they leverage these platforms to validate their product-market fit.

Metrics to determine product-market fit after launching a product

If the above tools deliver the expected numbers regarding customer interest, we can finally proceed to the long-awaited phase: building our product. However, this still doesn't prove proper product-market fit. If, against all our efforts up till now, our business model proves to be unsuccessful, we still have time to pivot.

We have closed the development phase and entered the growth phase. If we correctly use the tools I showed you above, the intent to buy will likely transform into actual purchases.

With this, we have successfully proven our first assumption (users are still willing to pay or exchange value for our product or service). But what about the other two? Let's which two we're talking about:

- we can keep our existing users, maybe even sell the additional products or services

- users like our product so much, they are willing to refer it to others

What metrics can we use to validate these? I will dedicate a separate article to metrics, but let's take a quick look at the most important ones right now. Before jumping in, though, I would like to point out one of the major mistakes startups make: they fail to resist the temptation of metrics magic.

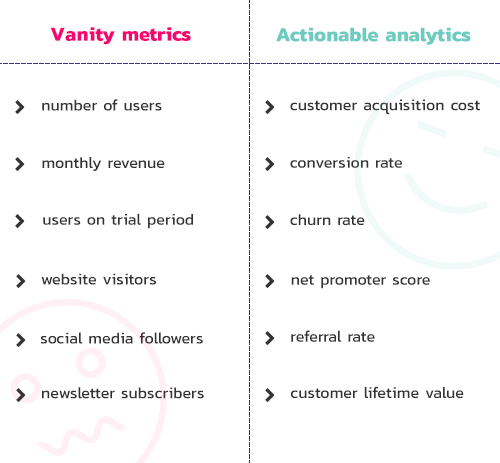

In his book titled The Lean Startup, Eric Ries told two distinct types of metrics apart. Vanity metrics and actionable analytics. Vanity metrics are great to make you feel good but are awful to base your decisions and strategy on. Inexperienced startups, however, do often commit this mistake.

The number of website visitors or social media followers is, for example, such a vanity metric. They look good, but they are of no use to us unless they turn into buying customers. Ok, this is pretty obvious, you might think.

Less obvious but equally vain is the number of users. There's no use having lots of users unless they are active. They need to spend money or add value in another way (for example, most Facebook users do not spend money on the platform, but their real value is in the information they generate for the social media giant).

Even less obvious but monthly revenue is also a vanity metric. Why? You might ask. If we do have revenue, we must have sales. True. But it doesn't say how much it costs us to acquire deals. For example, how much we spend on marketing to bring in a new customer. A manufacturer doesn't look at the price they're selling a product either. Instead, they focus on their margin on each sale.

On the other hand, actionable analytics are the ones that we should use to base our decisions on and use when planning long-term. I like to call these clarity metrics. Let's see a couple of examples.

Customer acquisition cost

Customer acquisition cost, or CAC, is the average spend to get a new customer. If, for example, we spend 800 EUR on Google Ads, which gets us 100 customers, our CAC will be 8 EUR.

To grow, most startups should focus on decreasing their CAC. If CAC doesn't drop in time, it's a good sign that our business model will not be sustainable long term. In some cases, though, especially when employing a paid growth engine, it can be acceptable for the CAC to remain consistent with the early values. Still, even then, a downwards trend is desirable.

Conversion rate

As I already mentioned, the number of website visitors or social media followers are vanity metrics. But the rate they become paying customers will be one of our essential clarity metrics.

Acquiring each visitor or follower (lead) costs us money, whether from a PPC advertising campaign or a PR appearance. The higher our conversion rate, the less we spend on marketing to acquire the same amount of users. Thus our CAC is going to be lower.

To increase conversion rate, we could run A/B tests or multivariate tests. An A/B test means that we take our landing pages and ads, creating multiple versions of them. These variations may differ in copy, design or layout. We then show these variations to our users in equal proportions. The ones which perform better and generate superior conversion rates are the ones we should concentrate on and polish further.

Churn rate

Churn rate is the metric that shows us our ability to hold on to users in the long run. It's important for the same reasons the conversion rate is important. The better we can keep active users, the less we must pay to replace them with new users.

Moreover, it's always cheaper to upsell existing customers' products or services than approaching cold leads since we have already established a rapport with them. When employing a sticky growth engine, the churn rate will be one of our foremost metrics.

Net promoter score and referral rate

Net promoter score is a widely used marketing metric, which indicates the likelihood of active users recommending our product to other people. It most often takes the form of a survey question.

The referral rate, or RR, is closely related to NPS. RR is the % of total sales, which come from the referral of active users. The better our NPS, the more likely we will have a high RR. RR will be our most important metric if using a viral growth engine.

Customer lifetime value

Customer lifetime value, often abbreviated CLV, CLTV or LTV, is the sum a single customer spends on average throughout their lifetime. If we have 1000 users, who spend a total of 10 000 EUR, our CLV will be 10 EUR.

If our CLV > CAC, we have a good indication that our business model is sustainable and we have achieved product-market fit.

Conclusions

It was a long journey, but we have reached the end of our product development process. The article series, however, does not end here. In the upcoming articles, I will elaborate on a couple of already mentioned notions. We're also going to take a look at scaling our product or service further and also answer some startup-related questions beyond product development. Bear with me!

If you liked this article, download the accompanying infographic!

I want the infographic